Don’t listen to the naysayers! If, you can read and follow basic directions you have a very realistic chance at making a fortune with cryptocurrencies with just a small investment.

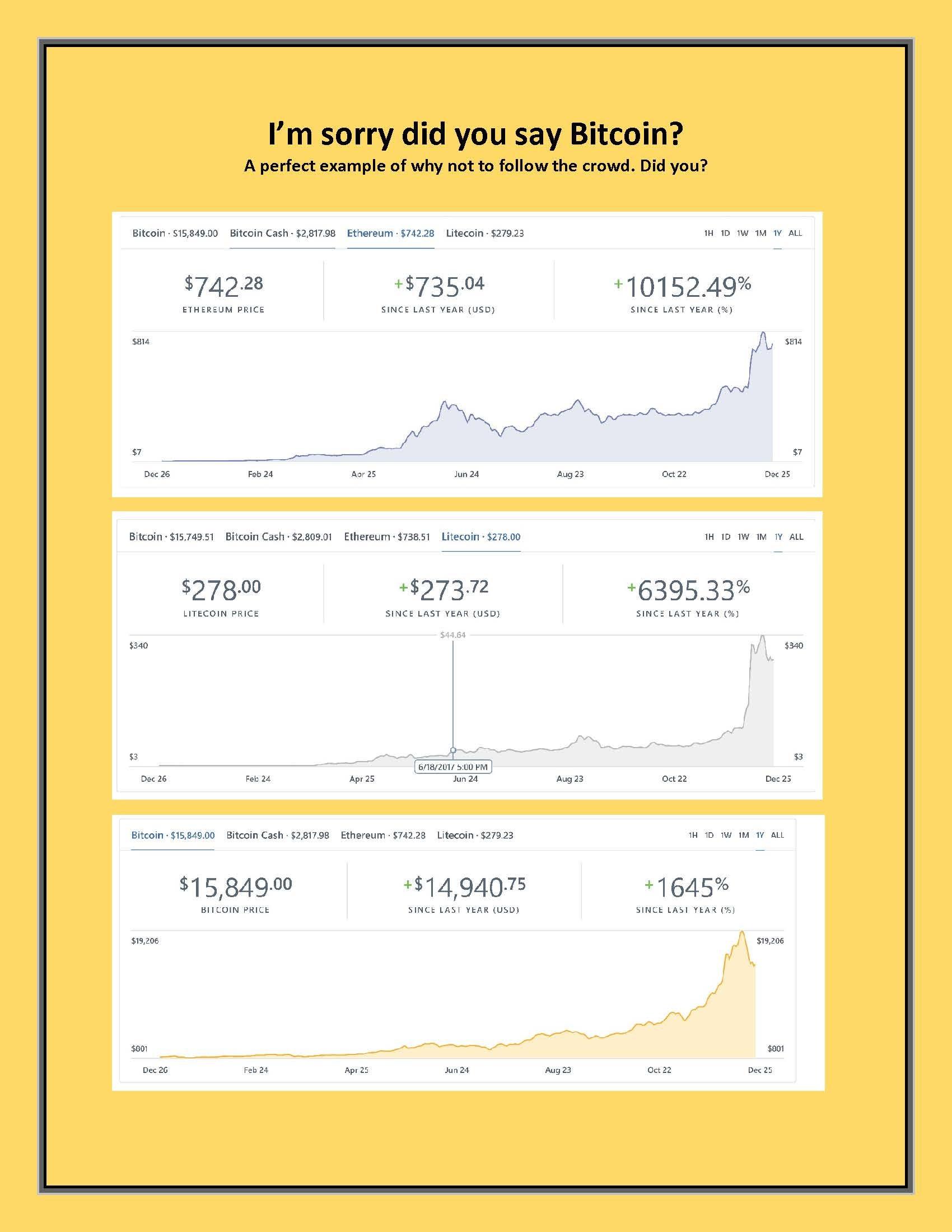

Scrutinizing the landscape reveals the average ICO (similar to a public offering of an early stage company) returned over 1,320%. This means a $1,000 investment returned on average $13,200. Had you invested $1,000 in either Bitcoin or Ethereum, the two most well-known currencies, at the beginning of 2017 you would have seen approximate returns of $16,000 (16x) and $100,000 (100X) respectively by year end.

Imagine rolling that money over a few times, hundreds of thousands and even millions of dollars could potentially be realized. These massive returns are not anomalies amongst cryptocurrencies. Yes, reminiscent of the 1997–2001 dot-com bubble when countless people became wealthy overnight and others lost their shirts. According to cryptocurrency mavens, such as Brock Pierce the founder of EOS the largest ICO to date, it’s still early in the game and with unprecedented opportunity.

Currently there are approximately 1400 cryptocurrencies. There are also new cryptocurrencies becoming available, through “initial coin offerings” (ICOs), regularly and getting access to invest in them is fairly easy.

So, why not take a chance at a fortune before it’s too late? Oh yes, failure! No one wants to experience a catastrophic financial loss and become the butt of endless jokes. Well, don’t let this opportunity pass you by because it just may be the last remaining opportunity of your lifetime for financial freedom or security.

Eliminate the risk and those not of similar mind and get on the path to a potential windfall before it’s too late. Take a small sum of money and say good bye to it like a frivolous night on the town, an expensive dinner, or a small vacation you will forego. Voila! You have now eliminated the risk and any attachment to the outcome. Remember, had bought $5 of Bitcoin just 7 years ago, you’d be worth more than $20 Million today.

Now, with risk and anxiety eliminated, it’s time to get started. First, open an account with an exchange that handles fiat currency, also known as paper money such as US dollars or Euros. You will need this type of account for when sell your currency and in exchange for fiat currency. Two popular fiat exchanges are Coinbase and Gemini. It’s best to have an account on more than one exchange. Fiat exchanges are scarce and often have limits, stringent guidelines and processing delays.

Second, research currencies to decide which ones to buy and locate the exchange where you may purchase them. I recommend reading the following articles before you purchase any currency:

https://www.tradingheroes.com/cryptocurrency-trading-guide-beginners/

http://jonathanbales.com/13-tips-investing-bitcoin-cryptocurrencies/

https://cryptovest.com/education/crypto-trading-tips-10-mistakes-beginners-need-to-avoid/

https://www.coinpursuit.com/pages/top-10/

Coinmarketcap.com is great for research and, among other things, offers a listing of all coins and tokens, pricing, ranking by market cap, performance charts and links to their websites where you may learn more about them including the wallet you will need to hold that currency. The “Markets” tab shows the exchanges where to purchase the currency and the currency needed to purchase the currency. For example, under the “Markets” tab is the “Source” tab and next to that is the “Pair” tab that shows which currencies you may use to purchase that particular currency. For instance, for the currency TRON (TRX), a pair “TRX/BTC” means you may purchase Tron (TRX) with Bitcoin (BTC). Two excellent sources for early stage investment leads are icodrops.com and icoalert.com.

Third, buy the proper currency to purchase the currency of your choice. In the above example, you would first purchase Bitcoin then use Bitcoin to purchase TRON. Most currencies can be purchased with either Bitcoin (BTC) or Ethereum (ETH).

Fourth, review the currency’s website and identify the wallet for the currency and either download or create it. Once this is done, send the currency from the exchange to the wallet.

There are various currency wallets. A wallet may be specific to just one currency or more generic and used for a variety of currencies. Some wallets are easier than others to download and use. Therefore, it’s best to research each currency’s wallet before purchasing it. Visit the currency’s website and perform a Google search if you are still unclear. Generally speaking, currencies that are ERC20 Compliant are the easiest to store.

Remember, currency is easily lost forever by sending it to the wrong address. Therefore, always keep track of your transactions by utilizing either a word document or notepad to copy and paste critical pieces of information such as your wallet address, password, transaction hash (TxHash), etc. Copying and pasting is best because transactions will involve long strings of letters and numbers that can be easily transcribed incorrectly causing the loss of your investment.

Like anything new, there is a learning curve getting prepared and comfortable with new words, terms and processes. Initially, set aside several hours to successfully complete a transaction and transfer the currency to its wallet. And remember, should you run into trouble, Google and YouTube are your best friends. YouTube is invaluable with its countless instructional videos. In my case, I was able to find videos that literally answered all of my questions and resolved all the issues I encountered.

Fifth, check out the exchanges that host the currencies you want to buy. Since there is no central exchange that hosts every currency, just visit and join the exchanges that trade the currency you seek to acquire or trade. Some popular exchanges are Binance, Poloniex, CEX.io, Cryptopia, and HitBTC.

Note that delays are commonplace and nominal transaction fees apply. Approval to trade on an exchange can take days or weeks and transactions frequently experience delays of hours, days and even weeks. During these periods you will not have access to your investment. Also, exchanges have their own values for each currency and so differences exist. Therefore, always compare exchange rates before trading to get the best deal.

Finally, don’t look to get rich quick, keep a long-term perspective and don’t panic and sell when a major drop occurs if you have invested in something that is of real quality. Good luck and good fortune!