Everyone I’ve ever met has at least one money monster, and some of us have several.

Our money monsters can lead us to unproductive behaviors like overspending, gambling or hoarding like a scrooge. They are the demons that haunt our financial houses.

Our money monsters are often the byproduct of an unhealthy relationship to money created by money trauma. Money traumas can create an anxious and/or avoidant relationship to money, which then feeds our money monsters.

For example, the monastery where I lived for 20 years had an extremely avoidant relationship with money — which is how we ended up in bankruptcy. I guess we took the vow of poverty a little too seriously.

Our avoidance of money manifested in several ways.

Our kindhearted business manager’s money monster was the Dude in Distress. The Dude or Damsel in Distress has a form of learned helplessness and prays that a knight in shining armor will magically come to the rescue. In this case, the white knight was God.

I learned the hard way that we cannot avoid money by pushing our responsibilities into God’s lap. Otherwise, it is sloth masquerading as faith.

However, I felt compassion for our business manager because his abusive father rejected and financially abandoned him. The abuse created deep emotional scars and the perpetual longing for a father figure to rescue him from his misery and love him as he deserved.

Our prior’s money monster was the Philosopher. The Philosopher views money as evil and something to be shunned at all costs. Our prior was proud of the fact he lived for years without touching money in any form, which only meant someone else had to touch it more often.

I later learned that our prior’s father was a wildly successful salesman and an alcoholic and gambler who routinely lost all his money at the racetrack, leaving his family destitute. With all the money wounds our prior had, it is no surprise he hated money because it triggered intense feelings of guilt and shame.

And I’m no better. For example, I took a vow of poverty, not because I was holy. I wanted to avoid any responsibility for money at all. That is why my money monster is called the Escape Artist.

In my family, money was like a virus engineered to be a weapon of mass destruction. Imagine if the coronavirus and Bitcoin had a love child.

However, after years of struggle and searching, I finally found a tool to help tame the money monsters roaming the halls of our monastery and fix our financial cluster bomb.

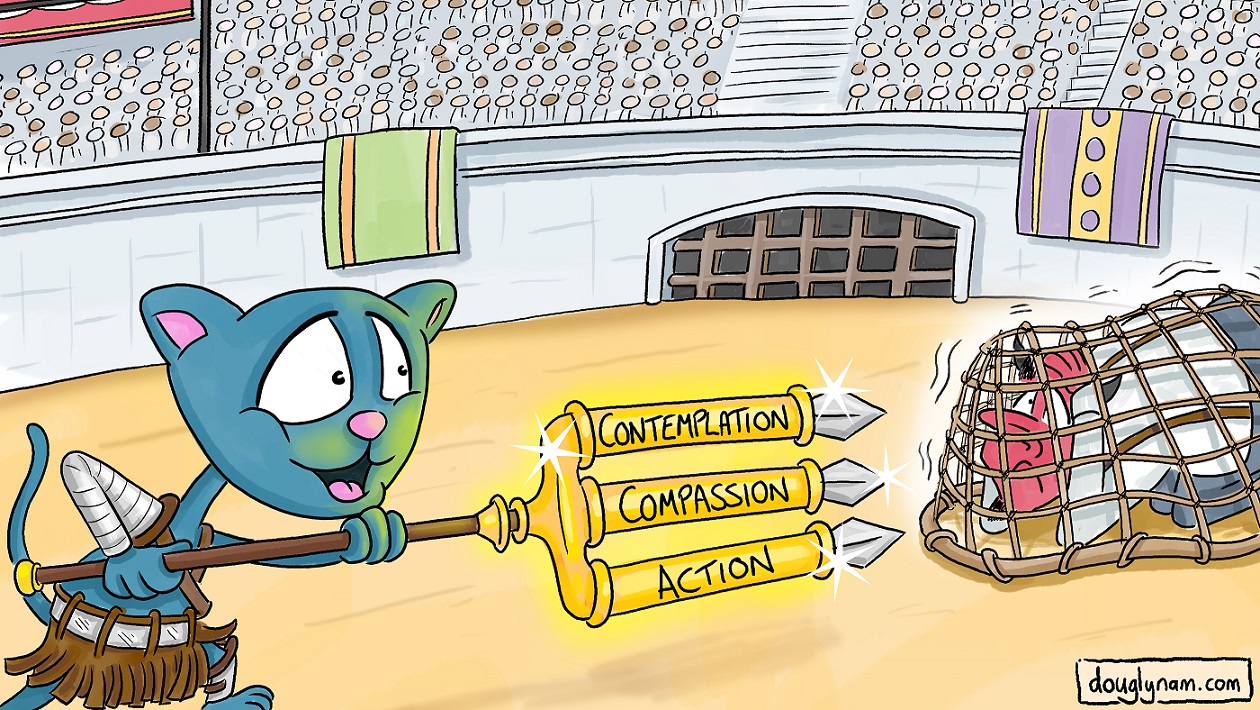

It is a three-pronged trident, forged of contemplation, compassion and action.

Contemplation can take the form of mediation, yoga or psychotherapy. Anything that helps you slow down and objectively see your self-defeating behavior. Where are you broken and a little bit crazy in your relationship to money? One of the quickest but most painful ways to find out is to simply ask people who want the best for you what your crazy is, because we all have it somewhere.

We also need compassion toward ourselves and others. Compassion can give us the courage to forgive and redeem the wounds that can distort our relationship to money.

This might be the psychological meaning behind the statement, “Forgive, and you shall be forgiven.” Only by practicing forgiveness toward others can we learn to forgive ourselves authentically. Otherwise, it is just narcissism. (Although Visa neither forgives nor forgets.)

We know what sound financial practices are. They don’t change: Build a budget, reduce debt, live below your means and invest. What we miss is the inner work necessary to take action and implement the practice. Before we can get our financial house in order, we first need to get our mental house in order.

By using the trident of contemplation, compassion and action, we can tame our money monsters and have a secure, healthy financial life.

Because money is not good or bad, it is merely a sponge that absorbs the intent of the user.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk’s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com.