The issues facing our country and planet have rarely felt so urgent and insurmountable.

With protests erupting in outrage at the death of George Floyd while in police custody, a widening chasm between the ultrawealthy and the rest of us, and a swiftly deteriorating ecology, it is hard to know where to direct our attention and resources as we struggle to survive a global pandemic.

One perspective on why so many uprisings are happening now can be found in the groundbreaking work of neuroscientist Jaak Panksepp. He discovered that mammals have a “play circuit.”

For example, rats love to wrestle, and dogs enjoy chasing each other. But if two rats wrestle, the bigger rat will win.

This presents a problem because the smaller rat will stop playing if he always loses, and then both rats suffer because the game ends. The solution is that the bigger rat will let the smaller rat win at least 30 percent of the time so they can both keep playing a game they love.

If we apply this analogy to the global capitalist system, we have a world where the big rats aren’t letting the rest of us win, even a measly 30 percent of the time, and we don’t want to play the game anymore.

As Nicholas Kristof reported in the New York Times in 2014, “The richest 1 percent in the United States now own more wealth than the bottom 90 percent.”

Most of the population is losing the economic and political game.

This is how the American, French, Russian and Chinese revolutions were born. And if we don’t radically change our economic priorities, we could have a revolution in the streets.

Our country is teetering.

Is there any hope on the horizon?

Calls for change are coming from around the world.

Among these, one hopeful trend is a rapidly growing army of investors, corporations and activists who are making environmental sustainability, social justice and responsible corporate governance an intrinsic feature of our economy.

This revolution affirms that we either all win or lose together.

How can we be a part of this trend of striving to make money a force for good?

As consumers, we can learn about the companies whose products we buy and support those who are committed to diversity, equity and inclusion. Websites such as Change the World by How You Shop (changetheworldbyhowyoushop.com) can help you make informed purchasing choices.

We can also support the growing number of companies that are committed to making business a part of the solution. Unlike conventional firms, these B Corporations think in terms of the triple bottom line: people, planet and profit.

Nationally, the B Corp community includes names like Patagonia, Ben & Jerry’s and Etsy. Locally, we have Taos Ski Valley, Meow Wolf and Positive Energy Solar. My own firm, LongView Asset Management, became a B Corporation in 2018.

As investors, we can join the growing ranks of shareholders who make investment decisions based on socially responsible criteria, also called ESG investing (environmental, social and governance). This approach directs capital toward corporations that operate responsibly and away from those that exploit workers, consumers and the planet.

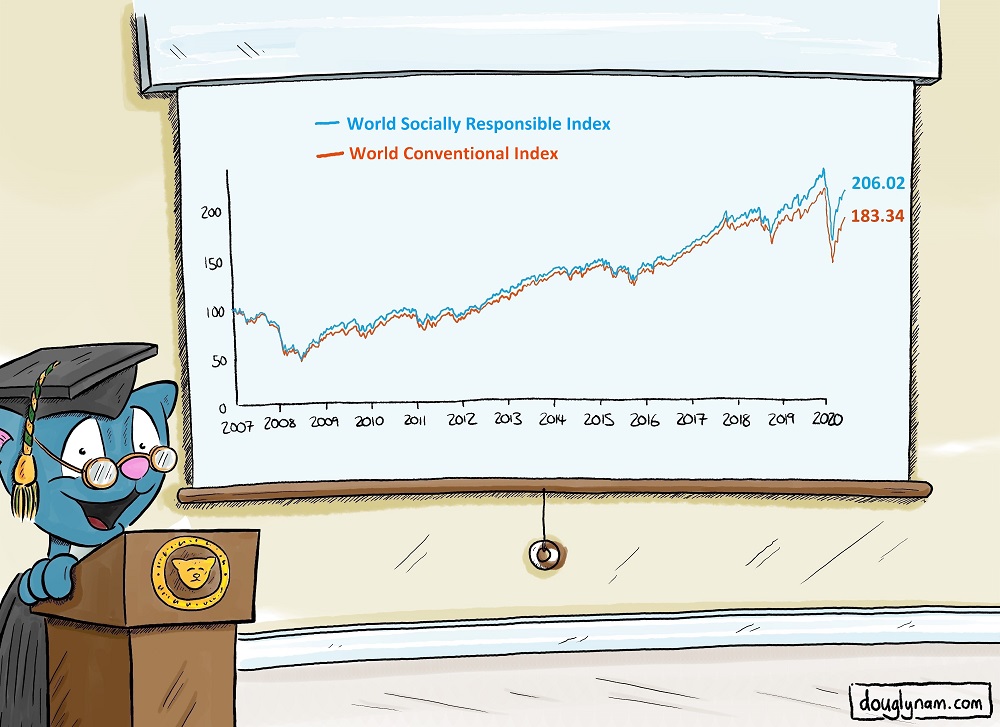

ESG investing can produce highly competitive returns. The accompanying graph shows it.

The red line on the bottom represents the performance of all the medium and large companies across 23 developed nations since 2007 (MSCI World Index). The blue line on top represents a similar list of companies but screens out those with negative environmental or social impacts (MSCI World SRI Index).

The 10-year annualized return of the socially responsible index is 1 percent higher than its conventional counterpart.

Over time, an additional 1 percent return adds up to a lot of money. And this is not an isolated data point; it is a robust trend verified by many studies. Companies that care about the future tend to do better in the future.

Capitalism can be harnessed to sustain our communities and the environment. But that requires us all to take responsibility for our spending and investing.

Unless we enthusiastically take part in a green revolution now, we may be subjected to a red one tomorrow.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk‘s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com.