I’ve always hated talking about money. In fact, I don’t like to think about my own money at all.

Helping others with money is fine, but I procrastinate on paying my bills and balancing my checkbook each month.

I get it done (and do it well), but sometimes I need to reward myself by pouring a stiff drink afterward — one of the few times when I drink. It settles my nerves and gives me the courage to face my own personal finances.

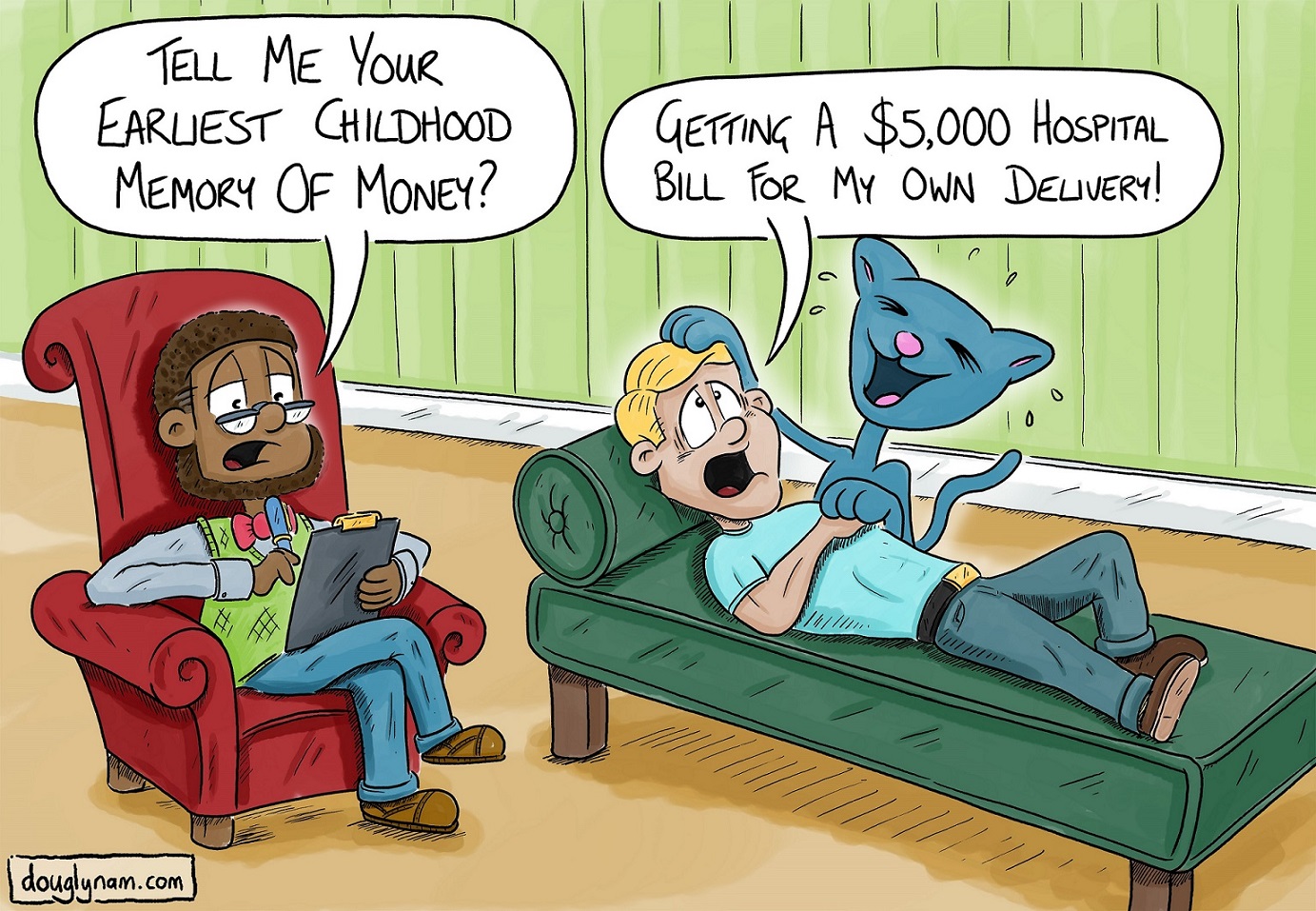

You’re probably wondering, why does a professional money manager have so much trouble finding the energy to pay his bills, even when he’s in good financial shape? Honestly, I think I’m one of the millions of people who have what might be called financial post-traumatic stress disorder.

Money has caused me so much stress, anxiety and hardship that giving my own finances attention triggers all the horrible memories and experiences I’ve had. And I’ve had a lot of them.

But I’ve learned if you ever want to have the peace of mind that comes from being financially secure, you need to face this stuff head-on. Triggers be damned.

As the local economy rapidly shrinks, many people are experiencing economic trauma, and their uniquely agonizing financial PTSD is settling in. The thin financial thread that held many of us together is fraying or already snapped.

Among some, their PTSD manifests as hyper-vigilance at the grocery store checkout counter where, even from 6 feet away and behind masks, I see folks anxiously watch the cashier tally each item. Or in a friend who lost her business, there is the 1,000-yard stare — dull eyes looking far away to a point in the past where everything fell apart.

The reason money stress is so difficult to bear is it threatens our identity, our ability to survive and the health of our loved ones. Money stress is toxic.

So what should you do if financial anxiety is plaguing you like the trials of Job?

First, examine your coping style. Are you stress-eating, drinking too much, or self-medicating inappropriately? Are you feeling enraged or depressed, or both? Are any of these getting in the way of taking action?

When money anxiety kicks in, we are likely to experience a fight, freeze or flee response. While you’ll need time to mourn appropriately and process a range of emotions, you don’t have the luxury of freezing or fleeing right now. At least not for long. You have to get up off the floor and fight.

Next, consider what practical actions are possible. Can you get a forbearance or extension on debt payments? Can you ask for reduced or delayed rent? Can you build a better budget? Can you apply for the Paycheck Protection Program or unemployment insurance? Is there a small business you can start to serve the needs of your neighbors and community?

Even tentative and fumbling steps in the right direction are better than complete paralysis. Or, as English writer G.K. Chesterton once said, “Anything worth doing is worth doing badly.”

Finally, get emotional help. Talking your problems out can help — a lot. Just having a sympathetic ear to listen and bounce ideas off can lighten the load.

We often need to talk out loud to think clearly, so consider finding a therapist, professional coach or financial adviser who can help you evaluate your options and see reality with greater clarity.

Ironically, when you are under financial stress and need psychotherapy the most is when you can least afford it. However, there are free or low-cost resources out there.

For example, the Tierra Nueva Counseling Center at Southwestern College and Presbyterian Medical Services both offer sliding-scale billing. La Familia Medical Center offers behavioral health services to existing patients regardless of ability to pay, and OpenPath.org can connect you with a low-cost, local psychotherapist.

In this season of sorrow, remember, you are not alone. Many of us have gone through similar difficulties before. We’ve made it to the other side, and so can you.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk’s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com