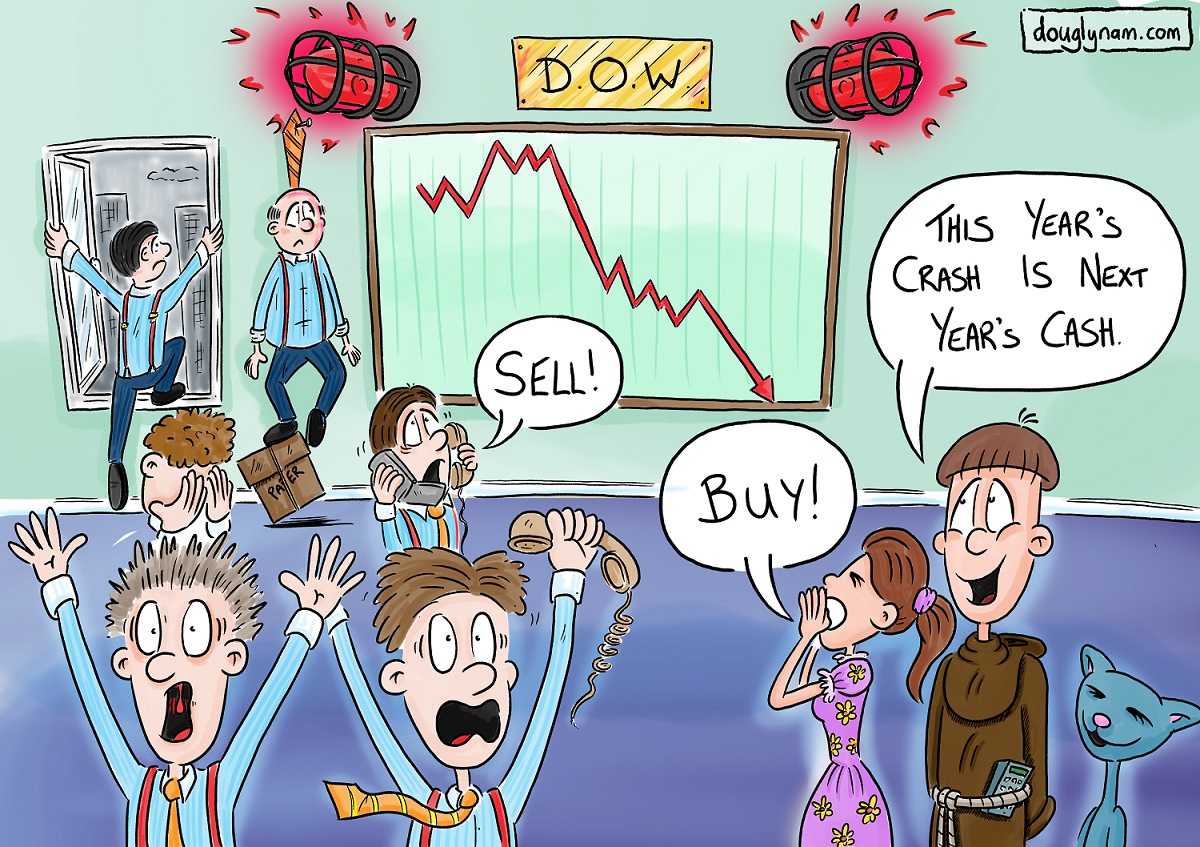

It’s natural to feel anxious these days. As the markets fall and our assumptions about normalcy shift as dramatically as the Dow Jones index, many of us worry about the repercussions the global crisis will have on our lives.

The primary question that races through our minds right now is, “What should I be doing with my money?”

The simple answer is, probably nothing. If you have a solid financial plan and proper asset allocation in alignment with your goals, now could be the worst possible time to make significant changes.

The data on this is clear: Panic selling is a losing game because you must accurately time not only when to get out of the market, but also when to get back in. It’s a close-to-impossible task.

For example, from Jan. 3, 2000, to Dec. 31, 2019, the S&P 500 had an annualized return of 6.06 percent. But if you missed the 10 best days of the market during these two decades, your return would only be 2.44 percent.

Complicating things further is the fact that six of the best 10 days occurred within two weeks of the 10 worst. In other words, when things look darkest can be the most crucial time to stay invested.

Last week is a perfect illustration. Following waves of historic losses, the Dow Jones rallied 21 percent in just three days — its strongest gain since 1931.

Under stress, our limbic systems kick into high gear with a fight, flight or freeze response. That often creates a compulsion to do something concrete to take back control when life throws us a curveball.

There are prudent actions to take now to protect your health and safety. Changing your financial strategy is probably not one of them. Markets like today are the reason we diversify among stocks, bonds and alternatives.

There is no doubt we are in for a challenging time ahead, but this too will end. Acting out of fear now can torpedo a buy-and-hold approach that has historically rewarded investors, even through the worst bear markets.

If you feel compelled to do something, then counterintuitively, the best long-term course of action may be to buy stocks while they are on sale. If the price of clothing dropped 50 percent, your first reaction wouldn’t be to sell your entire wardrobe at a consignment store. Instead, the prudent move would be to take advantage of sale prices.

Since we can’t know when the bottom will hit, one way you can take advantage of lower prices is to “dollar-cost average” using cash reserves to incrementally add money to stock positions or your retirement account over time.

If cash reserves aren’t available, you can accomplish something similar by rebalancing your portfolio when weightings stray too far from your allocation targets.

You can also take advantage of “tax-loss harvesting” by selling securities that have experienced a loss and reinvesting that money in a similar holding. The investment loss can then offset future gains or income, thereby reducing your tax bill.

It may be reassuring to remember there is only one rolling 10-year period on record when the stock market had a negative return. Markets have consistently rewarded long-term buy-and-hold investors.

My advice is to let the storm pass while taking shelter in the structure of a well-balanced portfolio. At the same time, bear markets such as this provide opportunities to make incremental but meaningful adjustments by rebalancing your portfolio, adding to your holdings through dollar-cost averaging and harvesting tax losses.

Making these moves will pay off over time — panic selling will not.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk’s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com.