When the polar vortex recently appeared over Naperville, Ill., the sleepy Midwestern town I grew up in, any lingering doubts I had about climate change froze like a runny nose in subzero Arctic winds.

The worst fears of climate scientists are now manifesting. Extreme weather is our new normal, wildlife extinction rates are accelerating and ocean life is dying.

Meanwhile, the Environmental Protection Agency is rolling back commonsense regulations, and key politicians self-servingly deny the climate facts that shape our new reality.

One of the most underreported pieces of environmental news takes the form of a technical report released by the U.S. Department of Labor called Field Assistance Bulletin No. 2018-01. In it, Joe Canary, director of regulations and interpretations, warns financial advisers that they could violate the law if they engage in socially responsible investing. If convicted, penalties may include compensatory fines, punitive fines and the revocation of professional licenses.

Understandably, this bulletin sent a chill over the investment community more bitter than the polar vortex. It rolls back an Obama-era bulletin that encouraged sustainable investing practices.

Canary’s logic is this: Registered investment advisers and retirement plan sponsors have a fiduciary duty to their clients. Fiduciary duty is the highest legal standard of care under the law, and it requires fiduciaries to always act in the best interests of their clients, just like a doctor, lawyer or therapist.

Canary narrowly defines the best interests of clients as maximizing investment returns and states that, “Fiduciaries are not permitted to sacrifice investment return … to promote collateral social policy goals.”

Therefore, registered advisers or retirement plan sponsors who exclude morally objectional investments, like fossil fuels, face potential legal risk. This is one reason why only 8 percent of retirement plans offer socially responsible investment options for employees, while according to a Natixis survey, 74 percent of retirement plan participants want these options.

The irony of this situation is that the long-term profitability of socially responsible investments is just as conclusive as the science behind climate change: Companies that care about the future tend to perform better in the future. On average, socially responsible investing has produced competitive or superior returns compared to conventional investing over the past two decades with less downside risk and lower volatility.

For example, the MSCI World Index, which contains all of the large and midcap stocks in 23 developed countries, has underperformed compared to the MSCI World Socially Responsible Index, which is the same group of stocks screened for ethical considerations. Since 2007, the MSCI World Index posted annualized returns of 5.78 percent, while the MSCI World Socially Responsible Index posted annualized returns of 6.49 percent. This isn’t an isolated data point. It’s a robust trend verified by countless studies.

Following this logic, instead of scaring Wall Street away from socially responsible investments, the Department of Labor should be doing the exact opposite. We know environmental, social and governance concerns are materially relevant to the performance of a portfolio, so every fiduciary should be required to consider these issues when making investment decisions for clients.

Moreover, fiduciary duty also requires financial advisers to act in the best interests of their clients and their client’s beneficiaries. And beneficiaries are often children, grandchildren and great-grandchildren. Destroying our children’s future is not in their best interests and is a clear violation of our fiduciary duty to them.

The total value of assets in U.S. retirement plans is almost $30 trillion. The total value of the U.S. stock market is approximately $23 trillion. If all that retirement money moves into sustainable investments, it’s enough money to create positive change on a global scale.

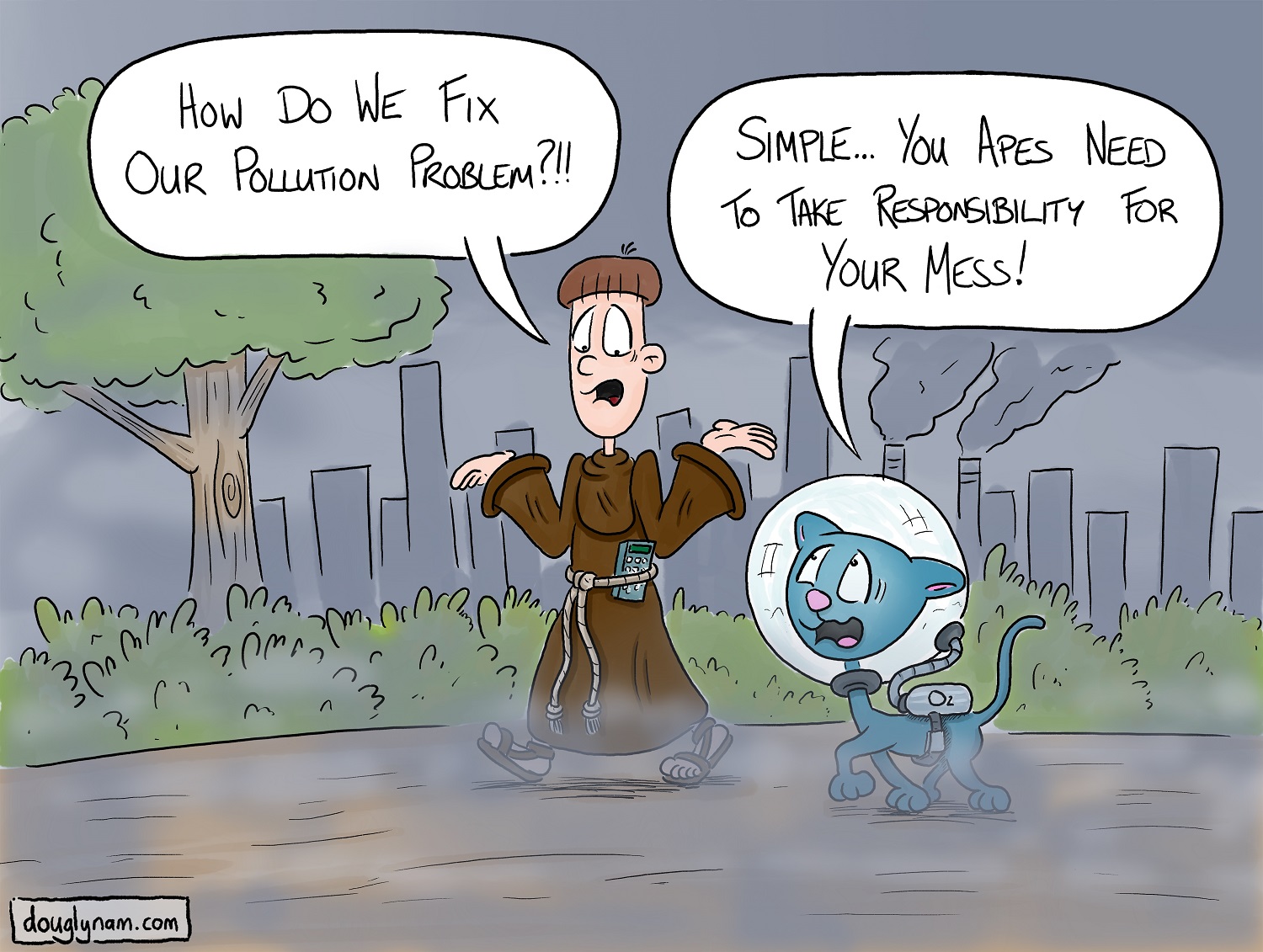

Meanwhile, let’s hope Canary’s efforts to dampen enthusiasm for sustainable investing die like the proverbial canary in a pollution-filled coal mine and that the Department of Labor crawls out of the coal pits into the fresh light of a new day. Doing so could build a brighter and healthier future for us all.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk’s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com