We all stress about money — it is a daily struggle to have a healthy relationship with our finances. We also stress about our environment: Sea levels are rising, polar ice caps are melting, and the weather is increasingly unpredictable.

We want to build a better world, but the demands of making a living and caring for our loved ones take up most of our attention. It often feels like our financial self-interest is in direct opposition to serving others.

Investors’ first goal is typically to maximize their rate of return with the least amount of risk. In a cage fight between profit motive and altruism, profit motive often wins. Which is why, as a monk for 20 years, I believed that renouncing money was the most effective way to help humanity. I learned I was mistaken.

As a financial adviser, it was a joy to discover that aligning your investments with your values can build wealth and a sustainable future.

We all need to save for retirement and grow a little wealthy. But we also need to save the planet for future generations. We want the highest possible returns on our investments while being good people. And here is the good news: Investing responsibly can do it all.

Socially responsible investing means caring for the Triple Bottom Line: people, the planet and profit.

In the past, environmentally and socially responsible investing often required accepting lower returns in exchange for avoiding the bad apples that made money from unsavory means.

However, as the number of funds practicing socially responsible investing has grown, costs have come down. In addition, we have amassed data proving that sustainable investing can produce competitive returns with lower downside risk. Environmentally and socially responsible investing is rapidly becoming the new normal — it’s just good business.

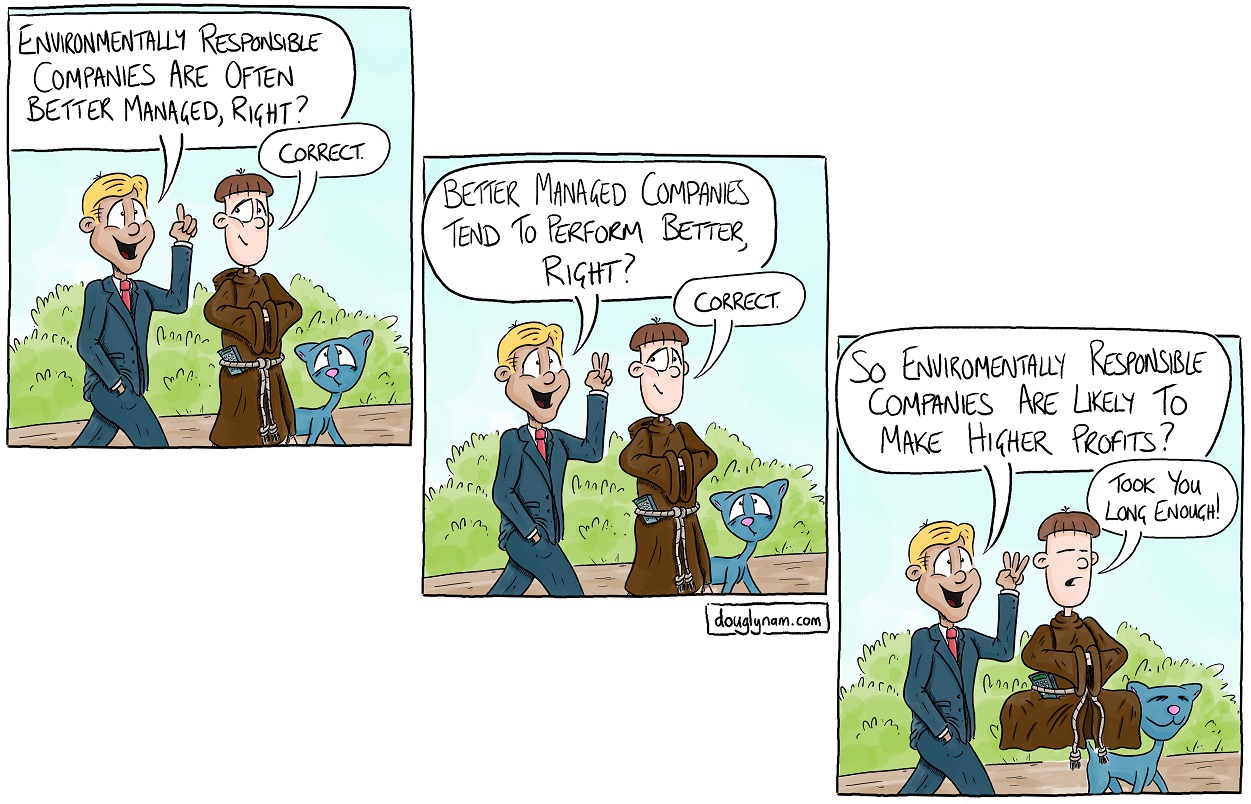

In 2015, Oxford University conducted a meta-study of more than 200 independent investigations into environmentally and socially responsible investing. Their findings were remarkable. They concluded that firms operating with sound sustainability practices are often better run and better investments.

Over the past 15 years, socially responsible investing has been comparable to or more profitable than conventional investing. This robust trend is verified by Deutsche Bank, Morgan Stanley, TIAA, Barclay’s, University of Cambridge, Hamburg University, the United Nations and more.

Sustainable investing has proved that investors can enjoy competitive returns with less downside risk than conventional portfolios. Finding higher returns with less risk is like seeing a leprechaun riding a unicorn while dancing to Louis Armstrong‘s “What a Wonderful World.” It’s awesome!

Which, in part, is why over one-fourth of all professionally managed money is now in socially responsible investing. It isn’t just a feel-good issue; it’s a smarter way to invest.

Companies that care about the future tend to do better in the future. If we can move the whole market into sustainable investing practices, we can protect the planet while growing ethically wealthy.

If your retirement plan has no sustainable investment options, ask your human resources department or service provider to add them. It’s not hard to do — someone only needs to demand them. And if they don’t know which funds to add, Dimensional Fund Advisors and TIAA have some excellent sustainable options.

And remember, as a general rule, you should be investing around 15 percent of your pre-tax income for retirement. But something is better than nothing, even starting at 1 percent.

I can’t promise anything about future returns in the stock market, but my money is on sustainable investing. If we are going down on a melting polar cap, I’m not going down without a fight. It is time to take responsibility for the world around us as we build our wealth. So, please, start investing sustainably today. Your retirement account and the next generation will thank you.

Most importantly, as your wealth grows, you’ll have less money stress. That alone is worth celebrating.

Doug Lynam is a partner at LongView Asset Management in Santa Fe and a former monk. He is the author of From Monk to Money Manager: A Former Monk’s Financial Guide to Becoming A Little Bit Wealthy — And Why That’s Okay. Contact him at douglas@longviewasset.com