Last month I wrote about my predictions for 2021 and operated under the assumption that Georgia would remain a red state. Oops. The shift to a blue state is significant because it removes all barriers to the socialist agenda that will be pushed by the Democratic Party.

For the purposes of this article, I will not talk about their social agenda, but I will discuss the consequences to capitalism and the significance of risk management moving forward.

The stock market is often viewed as a “predictor” of economic output six months into the future. If tight regulations were to return (Green New Deal) and taxes were increased on both corporations (Biden’s promise to roll back the Trump tax cuts) and investors (increase in capital gains taxes), the markets could see a significant pull back in the gains we have seen over the last six months.

Those gains were achieved by assuming there would be checks and balances in place at the federal government level and that there would be an end to this pandemic by mid-year in 2021.

It could spell even more trouble for small businesses (who might have to manage the challenges around a $15 per hour minimum wage) but favor large businesses who are in good graces with leadership of the Democratic Party (Facebook, Twitter, etc.)

Add to this the challenges that will most certainly be faced by the reintroduction of socialized medicine (health care companies represent one-sixth of our entire economy) and you will see significant risk to the old idea of just buying the index and walking away!

As investors, we cannot accurately predict what the price of a stock will be at the end of any given day, which direction that price will move on any given day, what the Federal Reserve will do with short-term interest rates (which affects both stocks and bonds), but we can spend time assessing and managing risk through strategic planning.

The challenge all of us have had with financial planning in the past has been that it takes too long to build one and the output is boring and delivered in silos. The spreadsheet output is often used to support the sale of some investment or insurance product, and old-school bar graphs are used to contrast outcomes from other product-oriented solutions.

The starting point for constructing a portfolio is usually a risk profile questionnaire that is used to identify the investor’s tolerance for risk. This flawed document will drive allocation policy for many years to come, but is often wrong about the family’s ability to handle risk.

The reason so many advisors rely on this document is because they are using the “institutional” method of financial planning. A risk profile can be accurately assessed when dealing with a larger group of people (like a board of a pension, foundation or endowment.)

However, institutions don’t get sick, hurt, laid off or divorced. People do! Why should we use this institutional method for humans who have a large bucket full of challenges that don’t apply to pensions, foundations and endowments?

As logical as my argument sounds, the institutional method of financial planning is still being used every day in major wirehouses, banks, trust companies and independent broker/dealers.

At the strategic level, planning should be purpose-based, include reserve accounts for challenges that could be faced by humans (layoffs, inflation reserves, etc), and risk should be managed according to the distribution date of each purpose-based portfolio. I call this process “aging of portfolios,” and it shows up most often in the Dynamic Map method of financial planning. Some compare this process to target-date investing, but in reality, aging is more conservative, which will be important during a period like the one we are about to endure.\

The benefit of aging a portfolio is it does allow for risk to be taken if the distribution date is way into the future. Risk is systematically reduced as the distribution date nears, by moving assets gradually away from risk toward income producing asset classes, and eventually highly liquid asset classes (like short-term U.S. Treasuries).

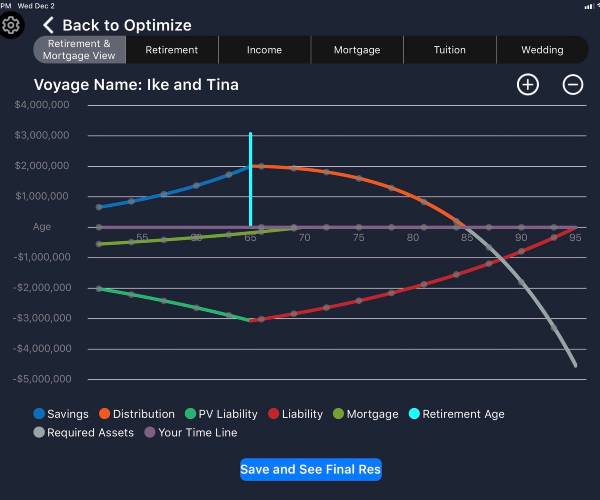

The Dynamic Map method also delivers a visual of the output that is intuitive for both advisors and investors, while enabling strategic thought by laying the present value/future value calculations out along the family’s unique timeline. This identifies conflict between family obligations and the Dynamic Map app allows for strategic changes which immediately change the image, allowing for the visualization of better outcomes.

Here is an example:

Ike and Tina are 51 years old. They are planning on living to age 95, They will need $9,500 (in today's dollars) per month in retirement. Retirement will begin at age 65. They currently have $660,000 allocated to retirement savings and contribute $900 per month. They are assuming a 7% rate of return on their investments and a 3% inflation rate. After checking the Social Security website, they are planning on receiving $2,200 per month in retirement income from Social Security.

They pay $3,400 per month to their mortgage, have an interest rate of 3.75% and a payoff amount of $550,000.

Their son, Sammy, is 16 and plans on attending college at age 18. The four-year educational cost is projected to start at $55,000 per year and they assumed an annual increase of 4% in college tuition. They currently have $170,000 set aside in his 529 plan and monthly contributions of $1,000.

Using the Dynamic Map app, their financial future looks like this:

.jpg.aspx;)

As you can see, there are a number of challenges they have to face. If these calculations were done in spreadsheet format, you might not notice the conflict between their retirement date and their mortgage payoff. In fact, the only thing that would stand out in a spreadsheet would be how they ran out of money at age 85. The video solution to this is here, and no investment products were needed to solve this challenging case study.

From a tactical perspective, managing risk can get as granular as weighting individual securities in a manner that is consistent with the times. Certain sectors will thrive in a Democrat-run government and others will struggle. Tax-loss harvesting will become a more common practice to limit the exposure to increased capital gains taxes under a Biden administration.

This is a commonly used strategy where securities are sold for a loss to offset capital gains that exist in other parts of the portfolio. Some advisors will do this with ETFs, but I think the potential to realize significant tax losses exist with individual stocks. The wash sale rule says the same security cannot be owned for at least 30 days.

There is no doubt in my mind that government spending moving forward will be some of the most extreme spending we have ever seen. The debt levels will significantly weaken the U.S. dollar, and inflation is even more of a risk than it already was. Building an inflation reserve account will be very important in the near future.

As you can see, managing risk will become the primary theme moving forward. Buying and holding index ETFs or index funds could be very challenging in the environment we are about to experience. Strategic planning will help investors remain calm and continue to thrive in the face of a socialistic agenda.

Jeff Mount is president of Real Intelligence LLC. Jeff has been active in the financial services business for the last 25 years.

Read Newsmax: Buckle Up! These Bumps Are Really Going to Hurt Investors! | Newsmax.com

Important: Find Your Real Retirement Date in Minutes! More Info Here